At any given time, around 26 million people in the UK show signs of vulnerability which puts them at risk of financial harm.

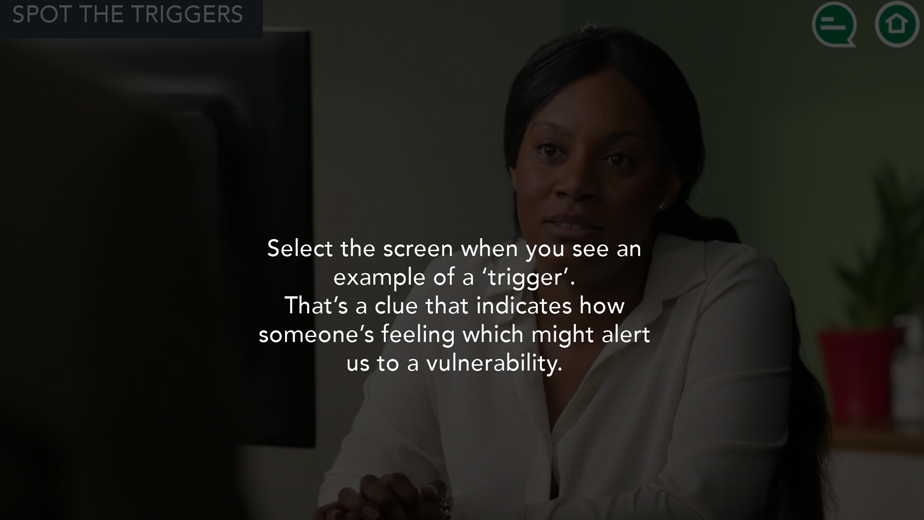

For bank workers on the frontline of customer services, it’s important to be able to spot the signs that mark customers out as potentially vulnerable. But more than that, bank colleagues need to be equipped with the right skills to be able to open up the conversation and find out more.

Adopting a tone that is reassuring and authoritative, learners are introduced to the module with a video of drone footage over a typical British city. A polished voiceover sets out the issues facing vulnerable customers and gives an overview of the module before learners land on a scrolling menu.

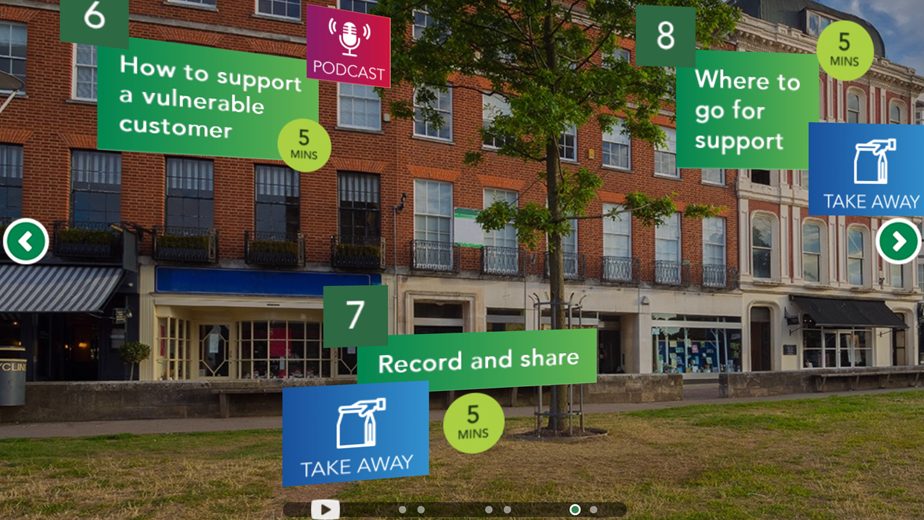

Against a backdrop of street scenes – a residential area and a business district representing both personal and business banking customers – learners work their way through four topics.

First, after seeing the FCA definition of vulnerable customers, learners use a quickfire true or false type game to apply their understanding of the definition to descriptions of different people. Feedback makes clear that vulnerabilities can be short or long term, and can cover a range of issues from ill health or a change in circumstances, through to life events and a lack of capacity to effectively deal with financial issues.

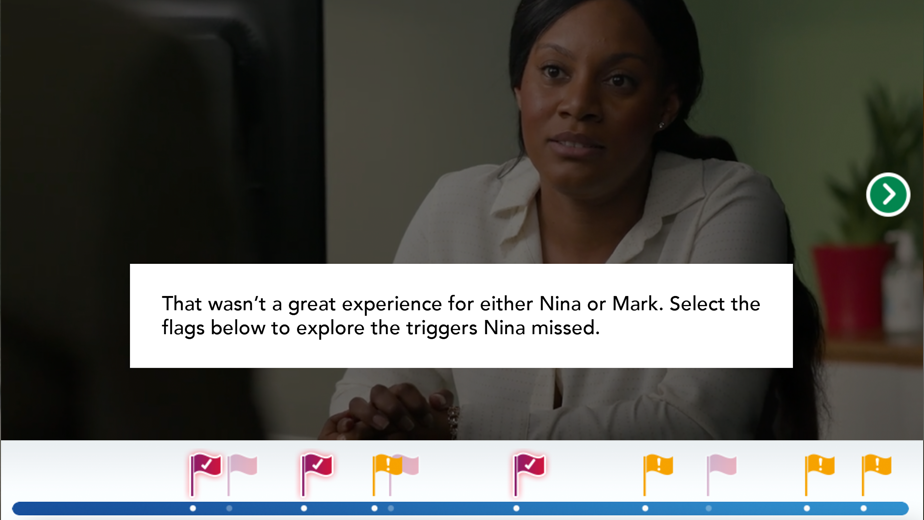

In the first of two interactive videos, learners are introduced to Marian, a woman in her 70s struggling with her memory. Her husband Peter is also her carer.

The story starts with Marian claiming to be missing a substantial amount of cash. Her husband tells her it’s not possible. Peter tells her she doesn’t have a pin on the account anymore so not to worry. What he doesn’t is that earlier in the day Marian visited her branch to get her pin reset. She has indeed taken out cash and lost it.

We then go back to the scene in the branch and review what bank adviser Natasha might have done differently to support Marian and help her keep her money safe.

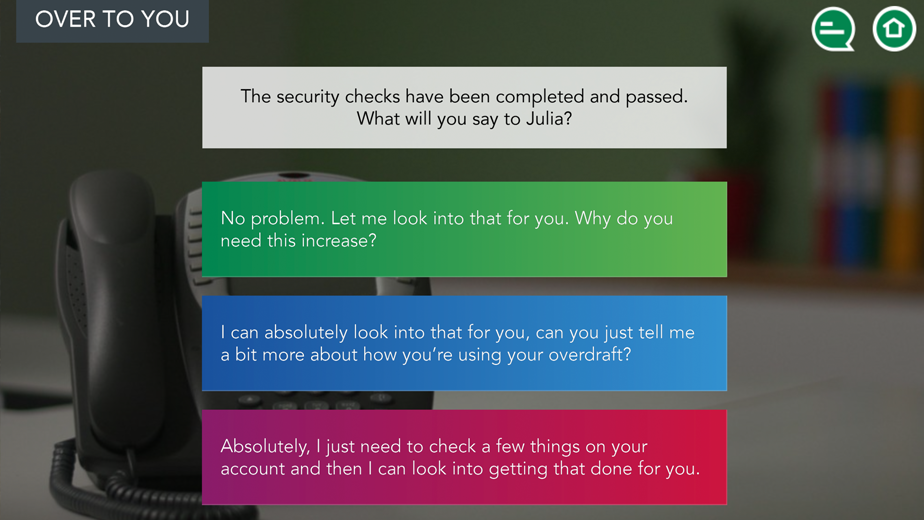

The second story focuses on a character called Julia, the owner of a small business that has been struggling to recover since Julia fell ill. Calling up Lloyds to ask for an extension of her overdraft, learners must use a combination of thoughtful open questions and non-judgemental language to get Julia to open up about her vulnerability. Only by doing so, can the learner achieve a better outcome for Julia.

We’re always happy to talk to you about how immersive technologies can engage your employees and customers. If you have a learning objective in mind, or simply want to know more about emerging technologies like VR, AR, or AI, send us a message and we’ll get back to you as soon as we can.